Reduce Litter

How can you reduce litter in your local waterways? If you see something, say something! Problems such as illegal dumping, pedestrian litter, and litter from cars and trucks all contribute to the waterway’s cleanliness. If you see trash on the street, be a good Samaritan and discard it in a nearby trash can. If you witness illegal dumping of debris or items down a storm drain, contact your local water authority to report any illegal activities.

Remove or replace toxic materials.

Some items are too toxic for our trash. Our environment has neither the capability nor the appetite to digest harmful chemical compounds. Luckily, there are facilities where you can turn in paint, batteries, pesticides, motor oil, and other similar materials for proper disposal. For safety and environmental reasons, it is illegal to dispose of these hazardous chemicals in the garbage, sewers, or storm drains. Residents of Spring Creek Utility District can follow this link to find their local hazardous materials drop-off point.

Participate in local clean-ups

There are many ways to get involved in keeping Texas clean. Here are some of the many programs you can join to help keep our state clean.

- Adopt-a-Highway dedicated to keeping Texas roadways clean.

- Adopt-a-Beach dedicated to keeping Texas beaches clean.

- Don’t Mess With Texas dedicated to community outreach.

- Trash Bash dedicated to keeping local waterways clean.

- Volunteer Trash Clean-Up Events With the Harris County Flood Control District

You can find more resources to participate locally or statewide here.

Texas residents must address the challenges posed by stormwater runoff to protect its waterways and preserve the biodiversity that makes the state unique. By implementing rainwater collection, litter reduction, replacement of chemicals, and participating in local cleaning efforts, Texans can work towards a healthier, more resilient environment for generations to come. Addressing stormwater runoff is not just an environmental imperative; it is a commitment to safeguarding the natural beauty and ecological balance that defines the Lone Star State.

Property market value: Estimated worth or price at which a property can be bought or sold in the Texas real estate market.

Property appraised value: Assessed or estimated value or a property, as determined by a professional property appraiser or by the local county appraisal district.

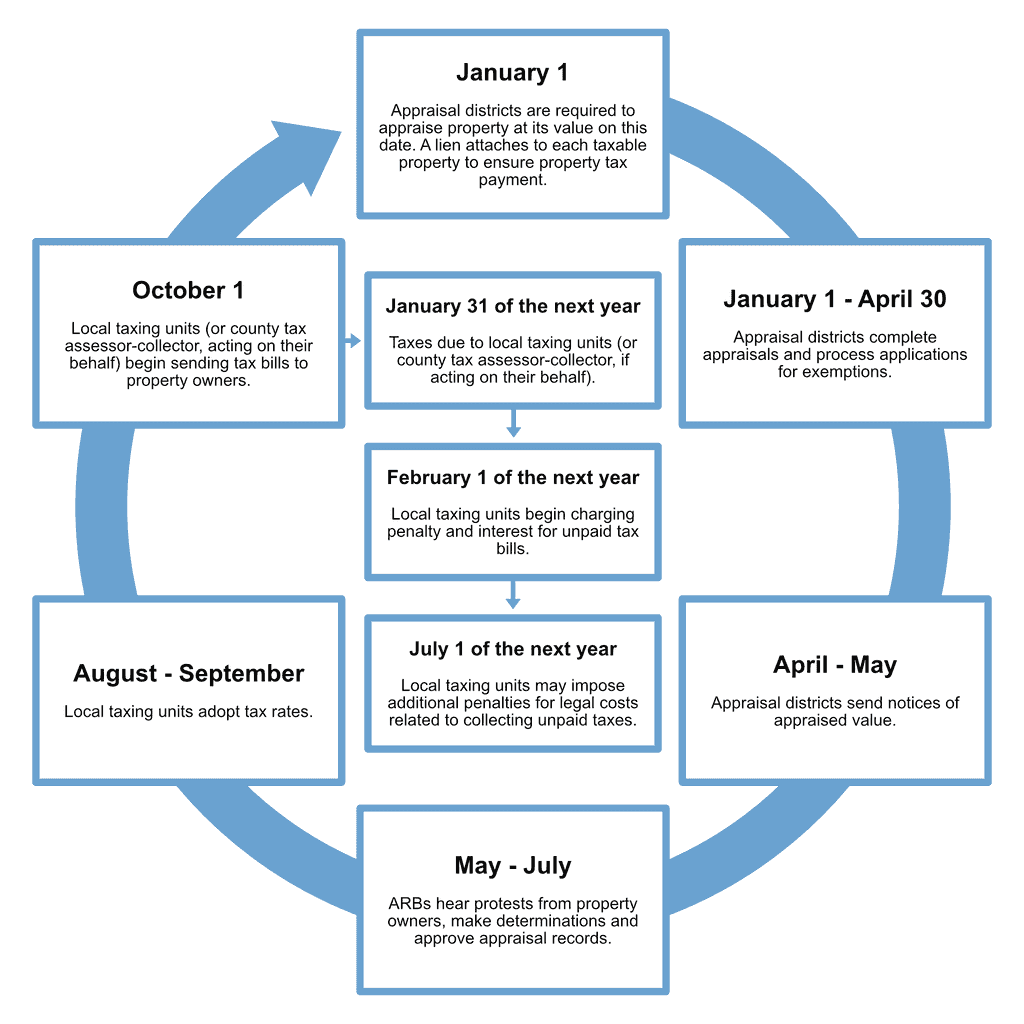

Your property's value is assessed each year on January 1st by the appraisal district and used to calculate your tax bill. Once the values are certified by the county appraisal district, the Board of Directors sets the tax rate for SCUD based on input from their financial consultants. Your tax bill is calculated by multiplying your property’s appraised value by the tax rate. There are a few exemptions that may apply to you, such as the Homestead exemption and the over 65 exemptions.

You can protest the value with the county appraisal district if you think it’s unfair or overvalued. Local entities set tax rates, and exemptions may apply. You should expect to receive your property tax bill in the mail by the end of October. You have until the end of January 31st of the next year to pay it without penalty.

Factors of Appraisal Price:

Location of residence

Condition of home

Size of home

Recent Sales of Similar Homes

Remember:

Your property's value is assessed every January 1st.

You can protest your appraised value if you think it is too high or low.

Local entities set their own tax rates.

There are a few exemptions that may apply to you.

You have until the end of January to pay your property tax bill without penalty.

Tax Bill Formula: (Home Appraised value – Exemptions) Divided by 100. Then multiply the product by the tax rate = your bill.

Watch this informational video produced by the Association of Water Board Directors (AWBD) to learn more.

SCUD has an over 65 or disability exemption of up to 55k.

SCUD has a homestead exemption of 20%

Residents should keep in mind they can now file for exemptions status year-round. For more information on tax exemptions and status, visit the Montgomery County Appraisal District Website.